公司简介

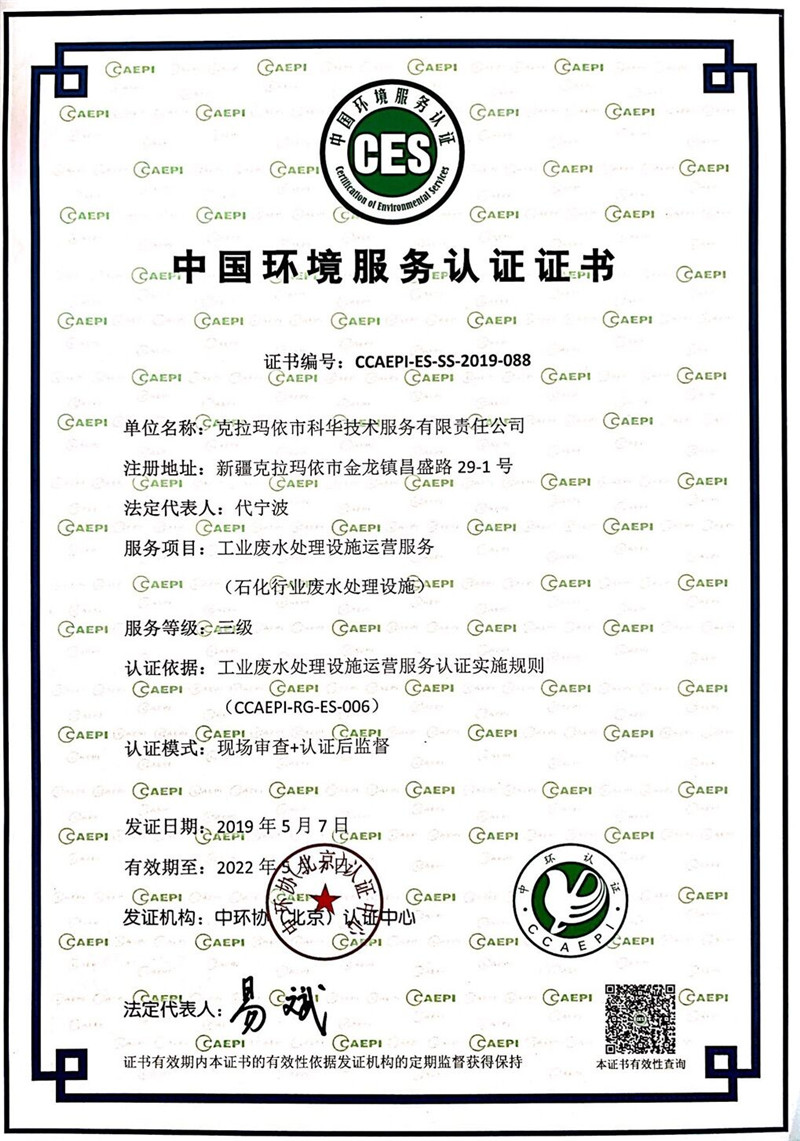

管家婆一码一肖资料大全四柱预测成立于2012年12月12日,是原克拉玛依石化公司设备研究所改制后组建而成,公司注册资本壹仟万元人民币整,具有独立法人资格。科华公司具有安全评价、职业卫生评价及检测、生态环境保护技术、石油石化设备检测、化工行业公用工程技术等方面具有专业的技术能力。2018年成立全资子公司:克拉玛依科华气体有限公司,专业从事气体充装、工业气体销售、空呼充装检验;2021年成立合资公司:新疆瑞博科华环保科技有限责任公司,专业从事加氢催化剂再生重生等。

科华公司2018年获得高新企业认证,2022年获得专精特新企业认证,拥有发明专利16项。公司有试验厂房1000多平米,实验楼5层4000多平米,科华气体厂房:550平米,催化剂再生厂:10000多平米。现有气相色谱仪、高效液相、原子吸收、原子荧光、紫外光度计、红外测油仪、烟气分析仪、电子天平、动态模拟装置等实验设备及精密仪器50多台套。氧气充装设备、气瓶电子标签扫码系统、呼吸器瓶空气充装设备、呼吸器瓶检测设备、催化剂再生生产线2条(年再生量3000吨),催化剂重生生产线2条,催化剂专用集中箱60个,催化剂硫碳分析仪1台,再生小试装置1台。

公司理念宗旨:“以人为本,诚信公正、质量第一”,弘扬“艰苦奋斗、开拓创新”的精神,努力加强人才队伍建设,引进新技术、新设备、新工艺,积极提升服务的深度和广度,创造更多的社会价值和效益。

报告公示

- 智慧石油(克拉玛依)投资有限公司九1-九5合作项目净化水增能注入工程职业病危害预评价报告 2024-10-08

- 智慧石油(克拉玛依)投资有限公司九1-九5区2023年开发作业地面工程职业病危害预评价报告 2024-10-08

- 智慧石油(克拉玛依)投资有限公司九1-九5合作项目净化水增能注入工程安全预评价报告 2024-10-08

- 智慧石油(克拉玛依)投资有限公司九1-九5区2023年开发作业地面工程安全预评价报告 2024-10-08

- 新疆永升聚元石油机械有限公司 2024-10-08

- 新疆中油国能油品销售有限公司自备加油站安全预评价报告 2024-10-08

- 中石油新疆销售有限公司乌鲁木齐分公司米东大道加油站安全现状评价报告 2024-10-08

- 中石油新疆销售有限公司乌鲁木齐分公司北外环加油站安全现状评价报告 2024-10-08

- 中石油新疆销售有限公司乌鲁木齐分公司七道湾西加油站安全现状评价报告 2024-10-08

- 中石油新疆销售有限公司乌鲁木齐分公司飞马加油站安全现状评价报告 2024-10-08

- 安全评价

- 职业卫生检测评价

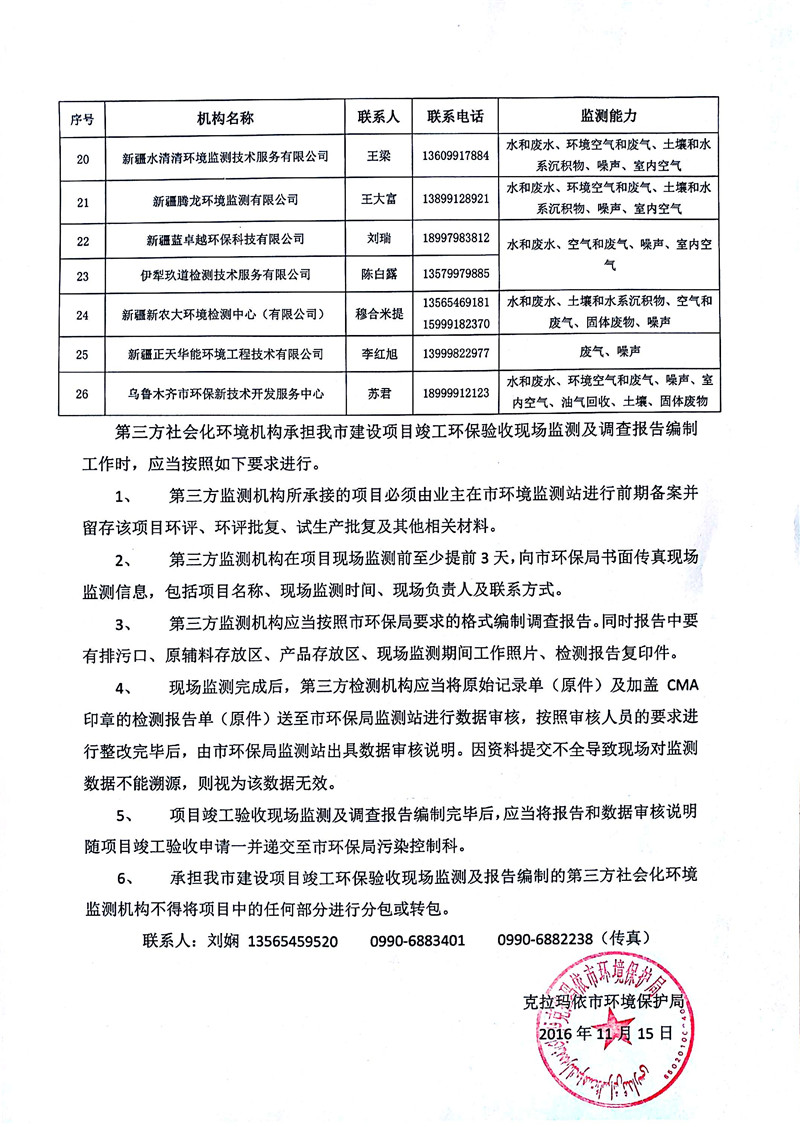

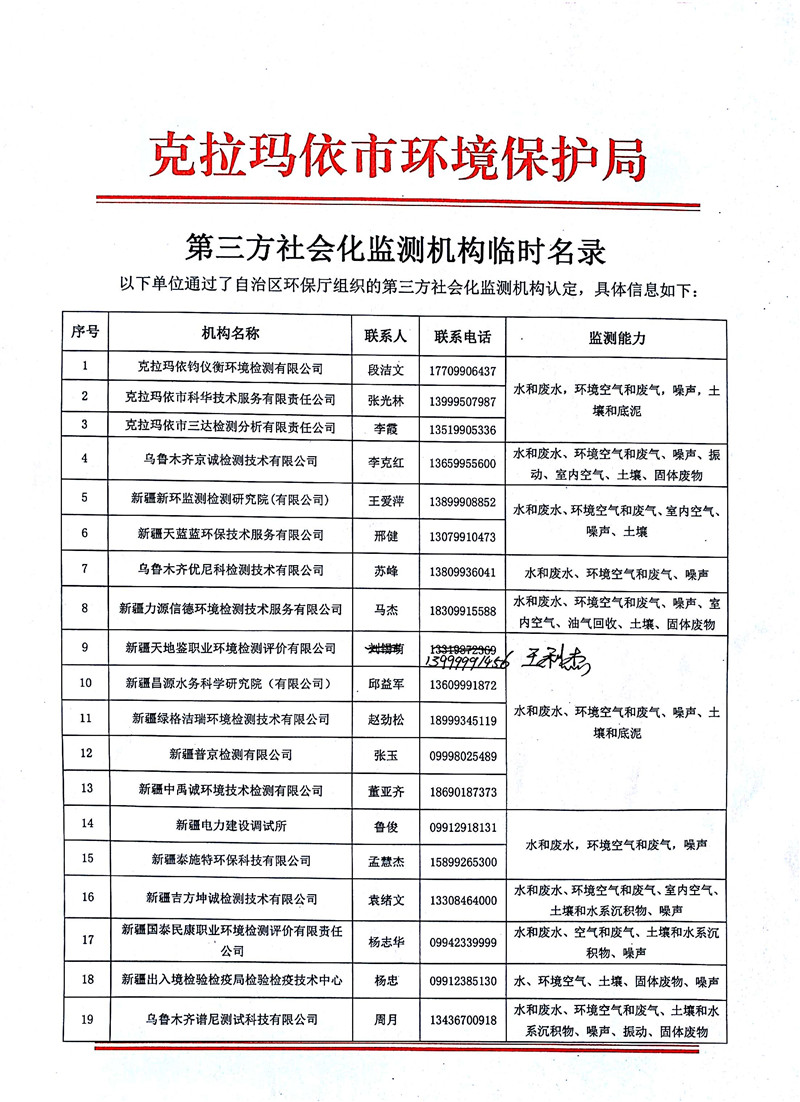

- 环境检测竣工验收

- 挥发性有机物检测

- 水处理技术服务

中国是世界四大文明古国之一,有着悠久的历史,距今约5000年前,以中原地区为中心开始出现聚落组织进而形成国家,后历经多次民族交融和朝代更迭,直至形成多民族国家的大一统局面。20世纪初辛亥革命后。

“十二五”时期,世情国情继续发生深刻变化,我国经济社会发展呈现新的阶段性特征。综合判断国际国内形势,我国发展仍处于可以大有作为的重要战略机遇期,既面临难得的历史机遇,也面对诸多可以预见和难。

建国之初,中国政府成功地在占全国农业人口总数90%以上的地区完成了土地改革,三亿农民分得了约4700万公顷的土地。1953年至1957年实施的第一个五年计划取得巨大成就:国民收入年均增长率达8.9%以上 。

可开展:环境空气VOCs(园区/厂界)在线监测、固定污染源废气VOCs在线监测、工业无组织排放VOCs监测 我公司具备LDAR平台,VOCs检测仪、专业技术人员,可全面帮助企业进行数据平台维护、建档、现场检测、数据录入、复测等,以及在线设备销售、安装及运行维护。

循环水技术服务包括:循环水系统运行、水质控制、循环水系统泄漏检查、冷换设备监测、系统和单台设备化学清洗、循环水系统和单台设备流量标定、水处理药剂动态模拟筛选、循环水药剂腐蚀性评价、循环水药剂阻垢性能评价、污水运营。 我公司具有20多年的循环水技术服务经验,为克拉玛依石化公司循环水处理取得了优异的效果,并主导编制了中石油公司循环水处理技术导则,在集团公司发布执行。

党建生活

收费依据

更多>>- 油新造价字[2013]3号__关于印发《新疆油田建设项目其他费用结算规定》的通知 2021-01-06

- 新疆维吾尔自治区环境监测和技术有偿服务收费管理办法(新发改收费[2010]761)号 2021-01-06

- 建设项目环境监测费用计价标准 附件--2019.12.5 2021-01-06

- 关于印发《新疆油田建设项目环境影响评价及验收费计价指导意见》的通知--2019.12.5 2021-01-06

- 关于环境影响评价及验收计费条款致函的回复---概预算管理部 2021-01-06

- 发改委关于降低部分建设项目收费标准的通知(发改价格【2011】534号) 2021-01-06

- 关于开展《职业卫生技术服务行业职业病危害因素检测收费指导意见》(试行)试点工作的通知 2021-01-06